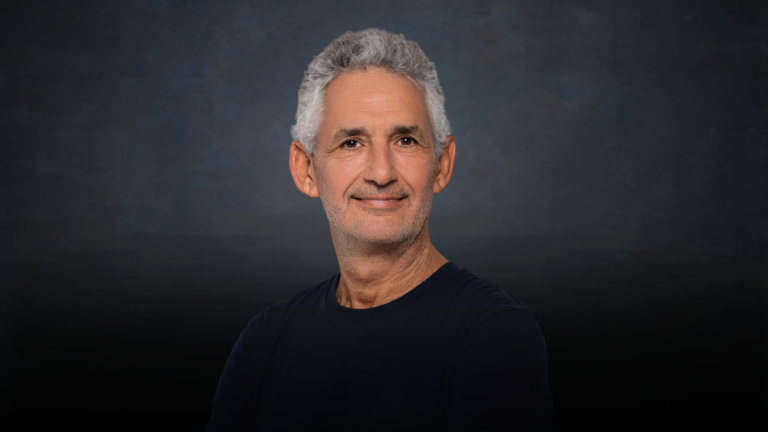

This week’s conversation is with Dr. Eric Johnson, a Norman Eig Professor of Business, and Director of the Center for Decision Sciences at the Columbia Business School.

He has been the President of the Society for Judgment and Decision-Making and the Society for Neuroeconomics.

His academic awards include the Distinguished Scientific Achievement Award of the Society for Consumer Psychology, Fellow of the Association of Consumer Research, and an honorary doctorate in behavioral economics from the University of St. Gallen in Switzerland.

Eric’s research examines the interface between Behavioral Decision Research, Economics and the decisions made by consumers, managers, and their implications for public policy, markets and marketing.

Among other topics, Eric has explored how the way options are presented to decision-makers affect their choices in areas such as organ donation, the choice of environmentally friendly products, and investments.

I wanted to have Eric on because I read his latest book, “The Elements of Choice: Why the Way We Decide Matters” – Decisions and micro-decisions are one of our greatest human privileges. It is our choices that ultimately reveal who we are. Eric has spent his life understanding the frameworks for decision making – how we set conditions, and how conditions influence us.

You’ll be fascinated by what Eric has to share about decision making.

“There’s been 30, 40 years of research on the idea that we use shortcuts or heuristics to make choices. And they do well most of the time… But, a lot of the shortcuts have blind spots.”

In This Episode:

Why is he fascinated by the architecture of decision making?

One of the things that struck me is that when I was making choices about colleges, I saw kids who were very bright decide, “I’m going to go to the community college,” and other kids who were about the same decide they would try for Ivy’s and other things. I was really interested in why they did that. I had a very small set and I was very lucky. I hit it off very much with some folks. Rutgers was a very good place for me. But what was interesting is people ended up with different choice sets, “I’m going to go to either X, Y, or Z,” or “I’m going to go to Harvard Swarthmore or Yale.” Those were the kinds of choices. And how did those choices sets come to be? And how did they decide that’s how they were going to limit themselves?

What makes a decision hard?

I think two things, one, I don’t talk as much about in the book, but it’s obvious, which is when you have conflicting goals. So the one example I do talk about, which I like is when we choose what to eat, we want something that’s delicious, filling, sweet, and we also want something that will make us, help us be felt. Now that it’s a conflict that many of our decisions have and those are the ones that are more open to be affected by the way they’re presented. Another thing is just things like the number of options. You can do a lot to make the same choice harder, easily. You can add more options. You can make the numbers used to describe them hard to process. You can use fonts that are hard to read. It’s something I think we all want choices that are fluent, that are easy, that flow. Fluent means flow. And that’s the other thing, lack of fluency makes choices hard.

What makes a “good” decision? A “bad” decision?

I think about a couple of things. One is, it’s pretty clear that a good decision should be consistent, that if I flip an attribute or describe something differently, you should pick the same thing, right? If that would be bad, because if someone can flip your choices easily, they can exploit you to come back to an earlier theme. Second thing is sometimes you make choices where when you look at it, the thing you choose is worse on every dimension. So let me give you an example, picking things like health insurance, lots of people are very confused by that decision. And there’s lots of nice research that shows that people choose policies that are the same as others, but just more expensive.

We are all both designers and choosers

When I first started thinking about doing the book, I was wondering whether I should write it for both designers, the people presenting choices or choosers, the people like us who are making choices. Of course, I realized quickly every day, we’re both. You talk to your spouse, you’re presenting choices. Where do we go to dinner? What do we watch on Netflix tonight? You’re a choice architect or as I call them a designer. At the same time, your spouse can turn to you and say, “Oh, here’s three vacation ideas.” So we’re all in both roles. And to make things simpler, I concentrated on the decisions the designer makes. But of course, by lifting the curtain a little bit, I think we also learn some of the tricks that designers can use.

From a designer perspective, how do we present better choices for others?

Your two goals as a designer are: One, to make the choice fluent – to make it seem easy to people. Because if it isn’t, they might not engage and they might not make a choice at all. The second, which is to make it accurate. And I defined accuracy. But something that’s in their best long-term interest. So for example, you want them to pick retirement plans that will get them more money rather than less. You want them to, if you have an account now, if you ask them questions about what their trade offs are for food, you probably can make sure that you can help them choose a better diet. So the idea, and I’m an optimist, is that a good designer is helping you make better choices. And I’m defining that both by fluency, that is, it should be easy and it should be accurate.

An example of fluency

Imagine I’m giving you a price… let’s use something like a gym. I could tell you it’s $10 a month or in a bizarre world, I could tell you that every time you go to the gym, we’re going to charge you $1.92 cents an hour. One is much more fluent than the other, easier to understand, and that’s a good example.

Small rewards now VS. bigger rewards later

One of the things that people study a lot in psychology and in neuroscience and in economics, it’s become a really important question is, how do people make choices between smaller rewards now versus larger rewards later? A classic case of this is, I study now for income, a better job later. I am teaching a group of Columbia MBAs right now. And I tell them, “You guys are giving up making income to come here and study. The reason is you think that in the future, you’re going to get a better job and make more money.” So that’s the kind of choice that you study in the lab, but it’s important because it’s what happens in the real world all the time.

Heuristics play a large role in decision making

So there’s been 30, 40 years of research on the idea that we use shortcuts or heuristics to make choices. And they do well most of the time. That’s sort of how we get through life. Daniel Kahneman famously coined the term system one versus system two system. System one is this automatic system that uses shortcuts. System two, does the math, or does much more complex thinking. And we would freeze if we always used system two. So system one is very important. But a lot of the shortcuts have blind spots. So one of the reasons in addition, people just freezing is when you give people too many options, they adopt a shortcut.

Dating sites as an example of choice architecture

There are dating sites, Tinder being one of them that give you an infinite number of options. And you might think that’s great. There’s another website that when it was started, it was started by three Korean women called Coffee Meets Bagel, and the goal was to make a site for women. And that presented you originally with just one option a day. So you might think they’re presenting you with dates. How could they differ? Well, on Tinder, people use a shortcut, which is called let’s look at the picture and they don’t look at the other information. They don’t look at somebody’s profile, where they live, what they’re looking for. And that’s probably pretty relevant information in many cases.

Choosing a “default” option

There’s a mismatch sometimes between the decision that really should be given a lot of effort and the ones we do. Retirement planning is a great example of this. Most people hate to think about it because it’s not very fluent. You have to think of all these terms. Or thinking about health insurance. There are a broad range of decisions that I think we think of as being important, but because they’re very hard, they’re not fluent, we tend not to engage in them. And so, one of the things I would try and do is make those decisions either easier, more fluent or get the right default so that if I don’t gauge, you get the right option. Much like the retirement plan. It used to be the case, there was no default. And so people save nothing. Now by giving people a default of saving three or four or 5% and putting them in a target date fund, people don’t engage in the decision and it’s hard to get them to engage, but now they have much better outcomes.

The biggest decision Eric had to make in his life

I’m quite lucky to be a cancer survivor. And so those were decisions [to use stem cell transplants] where I don’t feel like I have tremendous expertise. I had very, very good doctors, but still there were choices. And talk about consequences, I was very lucky the treatments worked. That was 21 years ago. But that was a decision with obviously high consequences. I was not an expert. I did read as much of the academic literature as I could, but ultimately, it was basically trusting in other people to help. And they did the right thing.